Unlocking Rhodium’s Value

Why Investing in Rhodium is a Game-Changer

Rhodium, a rare and valuable precious metal, has garnered significant attention in various industries due to its unique properties. This blog post explores the journey of rhodium from its extraction in mining to purchasing options from refineries and bullion dealers, while also delving into its applications in medical and energy-related catalysts.

Rhodium is primarily extracted as a byproduct of platinum and palladium mining, as it is often found in association with these metals within platinum group metal (PGM) deposits. The extraction process is complex and requires specialized techniques due to rhodium’s high melting point and its tendency to form difficult-to-process compounds.

- Mining Locations: The major producers of rhodium ore are South Africa, Russia, and Zimbabwe, with South Africa being the largest contributor to global rhodium supply. Rhodium deposits are typically located in layered igneous intrusions or alluvial deposits.

- Extraction Process:

- Exploration: Identifying viable rhodium-bearing ore deposits through geological surveys.

- Mining Methods: Utilizing underground or open-pit mining techniques depending on the deposit characteristics.

- Ore Processing: The mined ore undergoes crushing, grinding, and froth flotation to separate valuable minerals from waste materials. This step often yields a concentrate containing rhodium along with platinum and palladium.

- Refining: The concentrate is subjected to various refining processes such as smelting and electrolysis to produce high-purity rhodium. Techniques like solvent extraction and precipitation are commonly employed to remove impurities.

Rhodium ore typically contains a relatively small percentage of rhodium, often ranging from trace amounts to a few percent by weight. The complexity of extracting rhodium contributes to its high value and rarity as a precious metal. Additionally, its exceptional properties—such as high melting point (1,964°C) and excellent corrosion resistance—make it particularly challenging yet rewarding to extract.

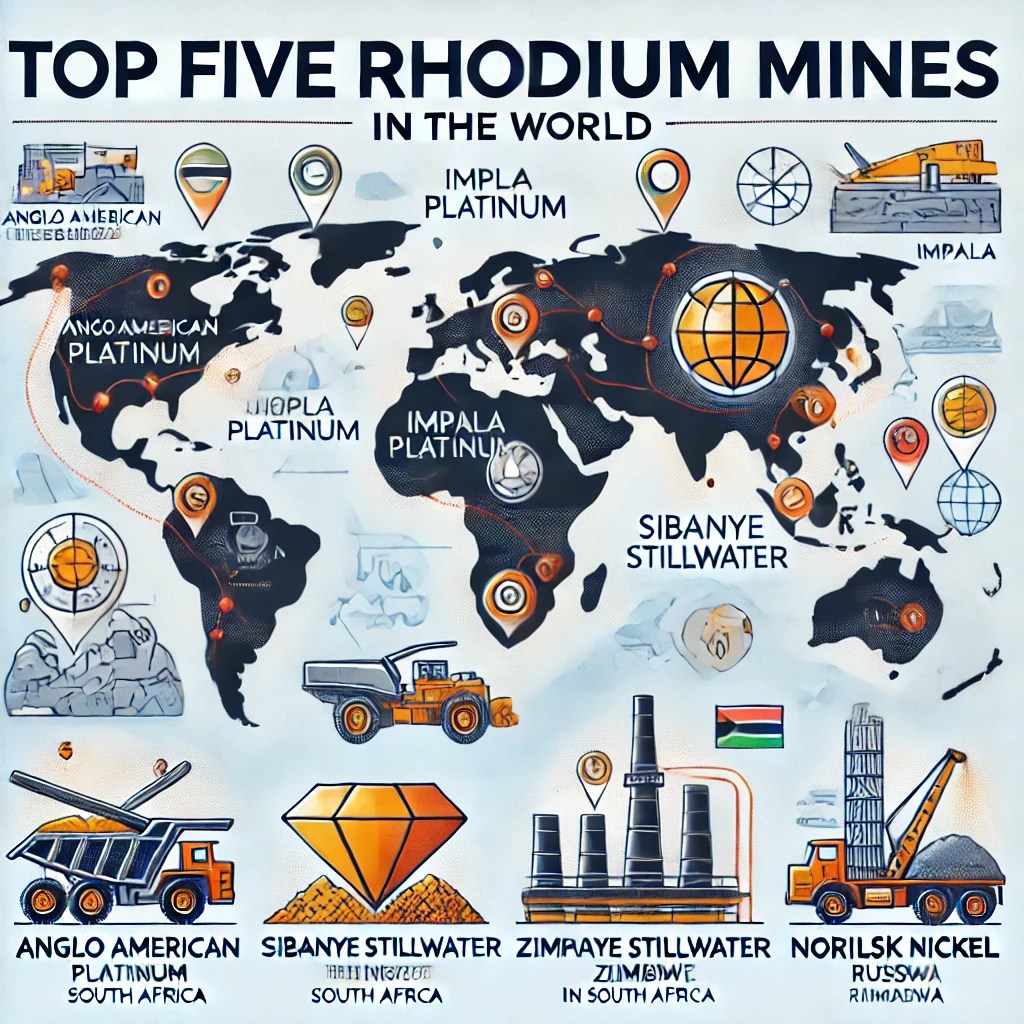

The Top Five Rhodium Mines in the World

The top five rhodium mines in the world are primarily located in South Africa, Russia, and Zimbabwe, where significant deposits of platinum group metals (PGMs) are found. Here’s a detailed overview of these mines and their resources:

1. Anglo American Platinum (South Africa)

- Location: Bushveld Igneous Complex, South Africa

- Production: Anglo American Platinum is the world’s largest producer of rhodium, contributing approximately 40% of global production. The company operates several major mines, including the Mogalakwena and Amandelbult mines.

- Resources: The Bushveld Complex is known for its rich deposits of PGMs, including rhodium, platinum, and palladium. The complex contains vast reserves of over 63 million ounces of PGMs.

- https://www.angloamericanplatinum.com/

2. Impala Platinum Holdings Limited (South Africa)

- Location: Bushveld Complex, South Africa

- Production: Impala Platinum is another leading producer, generating around 1.31 million ounces of platinum annually, with significant rhodium output as a byproduct.

- Resources: The company has extensive mineral resources estimated at over 131 million ounces of platinum and associated PGMs, including rhodium.

- https://www.implats.co.za/

3. Sibanye Stillwater (South Africa)

- Location: Various sites in the Bushveld Complex

- Production: Sibanye Stillwater has emerged as a significant player in the PGM market following acquisitions of various mining operations. It produces approximately 1.08 million ounces of platinum annually.

- Resources: The company’s operations include rich PGM deposits that yield substantial amounts of rhodium alongside platinum and palladium.

- https://www.sibanyestillwater.com/

4. Zimplats Holdings Limited (Zimbabwe)

- Location: Great Dyke region, Zimbabwe

- Production: Zimplats is a major producer in Zimbabwe, specializing in the extraction of PGMs. It has seen considerable growth and stability in its operations.

- Resources: The Great Dyke region is known for its extensive PGM-rich mineral deposits, with Zimplats holding significant reserves that contribute to its rhodium production.

- https://www.zimplats.com/

5. Norilsk Nickel (Russia)

- Location: Taimyr Peninsula and Kola Peninsula, Russia

- Production: Norilsk Nickel is the world’s largest palladium producer and a top producer of rhodium as well. The company produced around 700,000 ounces of platinum in 2019.

- Resources: The company extracts PGMs as by-products from its nickel and copper mining operations, with substantial reserves located in Russia.

- https://nornickel.com/

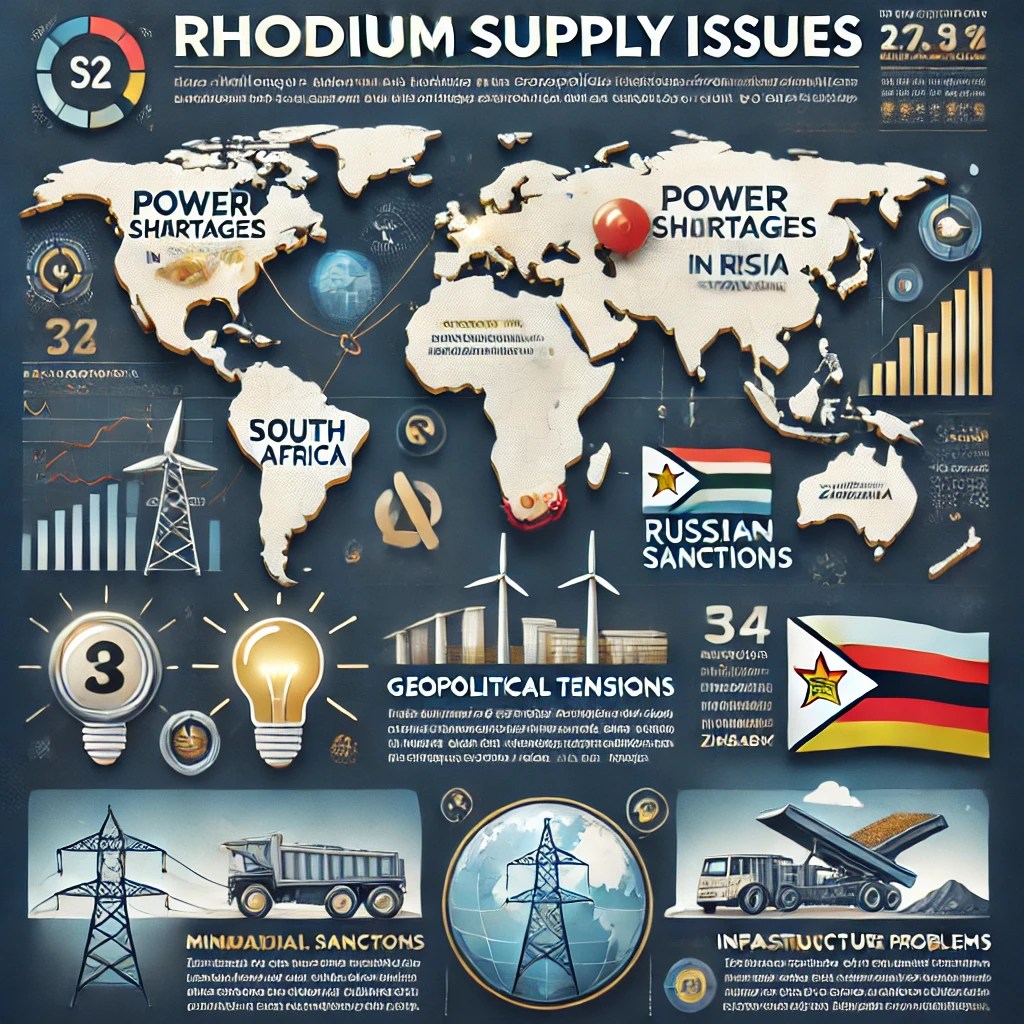

Rhodium Supply Issues

These mines play a crucial role in the global supply chain for rhodium, which is primarily used in catalytic converters for automobiles to reduce harmful emissions. The rarity and high demand for rhodium contribute to its significant market value, making these mining operations vital to both local economies and the global automotive industry.

The global supply of rhodium is currently facing significant challenges due to a combination of geopolitical tensions and domestic issues in key producing countries. Russian sanctions, stemming from the ongoing conflict in Ukraine, have disrupted the rhodium market by limiting exports from one of the world’s major producers. Russia contributes approximately 12% of global rhodium supply, and any trade restrictions exacerbate the already tight market conditions.

Meanwhile, South Africa, which accounts for around 80% of rhodium production, is grappling with severe power shortages caused by the state-owned utility, Eskom. Frequent load shedding and maintenance outages have forced mines to operate at reduced capacity, further constraining supply.

Additionally, Zimbabwe, another notable producer, faces its own set of challenges, including political instability and infrastructural issues that hinder mining operations. The combination of these factors is likely to lead to increased price volatility and supply uncertainties in the rhodium market, as demand remains robust, particularly from the automotive industry for catalytic converters.

Buying Rhodium from Refineries

Once extracted and refined, rhodium can be purchased from refineries in several forms:

- Forms of Rhodium Available:

- Rhodium Bars: These are typically produced through smelting processes and are available in various weights.

- Rhodium Powder: Often used in industrial applications, this form is produced through chemical processes.

- Rhodium Coatings: Used primarily in jewelry and electronics for their reflective properties.

- Purchasing Process:

- Buyers can approach specialized precious metal refineries that handle the sale of refined rhodium. These facilities provide certificates of authenticity and purity, ensuring that customers receive genuine products.

- Prices may vary based on market conditions, purity levels, and the form of rhodium being purchased.

The refining process itself is intricate; it involves several steps such as smelting, acid digestion, precipitation, filtration, calcination, and finally refining through methods like electrolysis or chemical reduction. Each step requires precision to ensure that the final product meets the high purity standards required for industrial applications.

5 Rhodium producing Refineries

1. Metalor Technologies (Switzerland)

- Location: Neuchâtel, Switzerland

- Overview: Metalor is a leading precious metals refiner with a long history in the industry, specializing in refining various metals, including rhodium. The company emphasizes responsible sourcing and high-quality standards, processing rhodium from both primary and secondary sources.

- https://metalor.com/

2. Heraeus Precious Metals (Germany)

- Location: Hanau, Germany

- Overview: Heraeus is one of the largest precious metals refineries in the world, refining a wide range of PGMs, including rhodium. The company is known for its advanced refining technologies and commitment to sustainability, processing materials from various origins, including recycled catalysts.

- https://www.heraeus-precious-metals.com/en/

3. Johnson Matthey (United Kingdom)

- Location: Royston, England

- Overview: Johnson Matthey is a global leader in sustainable technologies and precious metals refining. The company refines rhodium as part of its extensive portfolio of PGMs and focuses on innovative recycling processes to recover metals from used catalysts and other industrial sources.

- https://matthey.com/

4. TCA Spa (Italy)

- Location: Castelluccio and Valenza, Italy

- Overview: TCA Spa specializes in the recovery and refining of precious metals, including rhodium, from various scrap materials. Their facilities utilize advanced pyrometallurgical and hydrometallurgical processes to ensure high purity levels in the final products.

- https://www.tcaspa.com/en

5. Umicore (Belgium)

- Location: Brussells, Belgium

- Overview: Umicore is a global materials technology and recycling company that operates one of the largest precious metals refineries in Europe. They specialize in recycling PGMs, including rhodium, from electronic waste and spent catalysts, contributing significantly to sustainable metal sourcing practices.

- https://www.umicore.com/

These independent refineries play a crucial role in the global rhodium supply chain by processing materials from diverse sources and ensuring that high-purity rhodium is available for industrial applications, particularly in automotive catalysts and electronic components.

Acquiring Rhodium from Bullion Dealers

In addition to purchasing directly from refineries, individuals can also buy rhodium from bullion dealers. This option is particularly popular among investors looking to diversify their portfolios with precious metals.

- Finding Reputable Dealers:

- It is crucial to select established bullion dealers who have a good reputation in the market. Look for dealers who provide transparent pricing, clear product descriptions, and reliable customer service.

- Transaction Types:

- Bullion dealers typically offer both physical products (like bars or coins) and paper products (like ETFs or futures contracts) that track the price of rhodium.

- Transactions can often be completed online or in person, depending on the dealer’s business model.

- Market Considerations:

- The price of rhodium can be volatile due to its limited supply and high demand in industries such as automotive catalytic converters and electronics. Buyers should stay informed about market trends before making purchases.

5 Rhodium Dealers Globally

1. Baird & Co

- Location: London, United Kingdom

- Overview: Baird & Co is a full-service bullion merchant and gold refiner in the UK. They trade in various precious metals, including rhodium, and offer a range of products such as bars and coins. The company is known for its commitment to quality and customer service.

- https://bairdmint.com/

2. Indigo Precious Metals

- Location: United Kingdom

- Overview: Indigo Precious Metals focuses on trading various precious metals, including rhodium. They offer personalized service to cater to both individual and institutional clients looking to invest in precious metals.

- https://www.indigopreciousmetals.com/

3. Kitco Metals

- Location: Montreal, Canada

- Overview: Kitco is a well-established dealer in precious metals, offering a variety of products, including rhodium. They provide market analysis, real-time pricing, and a range of investment options for individual and institutional investors.

- https://www.kitco.com/

4. Silver Bullion

- Location: Singapore

- Overview: Silver Bullion is a dealer that offers a wide range of precious metals, including rhodium. They provide secure storage solutions and emphasize transparency and customer satisfaction in their services.

- https://www.silverbullion.com.sg/

5. Sprott Money

- Location: Toronto, Canada

- Overview: Sprott Money specializes in precious metals trading, including rhodium. They focus on customer service and provide educational resources to help investors make informed decisions about their investments.

- https://www.sprottmoney.com/

Applications of Rhodium

Rhodium’s unique properties extend beyond its use as a precious metal; it plays a crucial role in various industrial applications:

- Catalysts: Rhodium is widely used in catalytic converters for automobiles due to its ability to facilitate chemical reactions that reduce harmful emissions. Its catalytic properties are also utilized in chemical production processes.

- Medical Applications: In the medical field, rhodium is employed in certain types of catalysts used for synthesizing pharmaceuticals. Its high stability under extreme conditions makes it suitable for various medical applications.

- Energy-Related Catalysts: Rhodium catalysts are increasingly being researched for their potential use in energy-related applications such as hydrogen fuel cells. Their efficiency in facilitating reactions makes them valuable for developing cleaner energy solutions.

Rhodium for Sale In Summary

The landscape of rhodium trading is shaped by a complex interplay of supply dynamics, geopolitical factors, and market demand. As a highly sought-after precious metal, rhodium plays a crucial role in various applications, particularly in automotive catalysts where it helps reduce harmful emissions. Understanding the extraction processes, refining methods, and available purchasing options is essential for investors and industry stakeholders alike.

With the challenges posed by geopolitical tensions and energy issues in major producing countries, securing reliable sources of rhodium has become increasingly important. Independent dealers such as Baird & Co, Indigo Precious Metals, Kitco Metals, Silver Bullion, and Sprott Money provide vital access to this valuable metal, offering a range of investment products and services tailored to meet the needs of both individual and institutional investors.

As the demand for rhodium continues to grow, particularly in the context of sustainability and environmental regulations, staying informed about market trends and reputable dealers will be key to navigating this dynamic sector. For further insights into related topics, consider exploring our articles on the complete list of platinum group metals, refining gold, top gold dealers, international gold refiners, and the gold mining sector.

Whether you are an investor looking to diversify your portfolio or an industry professional seeking reliable supplies, understanding the intricacies of the rhodium market will empower you to make informed decisions in this evolving landscape.

Still Looking for Rhodium for Sale?

If you’re looking to invest in rhodium or have any questions about purchasing options, don’t hesitate to reach out! Contact Us today, and our team will be happy to assist you with all your rhodium buying needs.